Roth ira contribution calculator 2020

Offer valid for returns filed 512020 - 5312020. Roth IRA contribution limits are the same for 2021 as they were for 2020 with consumers who earn a taxable income allowed to contribute up to 6000 across their IRA accounts.

Roth Ira Calculator Roth Ira Contribution

Roth IRA Income Limits.

. Roth and Traditional IRA Contribution Limits for 2021 and 2022. An Inherited IRA or a Beneficiary IRA is an account that is opened when someone inherits an IRA or employee-sponsored retirement plan after the death of the original owner. When you start taking withdrawals you then need to report the appropriate amounts as income on your tax return and.

Starting at age 72 age 70½ if you attained age 70½ before 2020. Whether an IRA is deductible or not is determined by a separate IRS formulaEven if you are above IRS limits to. View the current and historical traditional and Roth IRA contribution limits since 2002.

Traditional IRA contributions. There are limits for an individual contribution and an age 50 catch-up contribution. This is up from 58000 in 2021.

In 2021 you could put in up to the IRA contribution limit if your modified AGI is less than 125000 if your filing status is single or 198000 if you are married and filing jointly. As a beneficiary you cant make additional contributions but with an Inherited IRA the funds can remain tax-deferred and you can generally withdraw money right away. Your filing status is single head of household or married filing separately and you didnt live with your spouse at any time in 2021 and your modified AGI is at least 125000.

You can contribute up to 25 of employee compensation or 61000 in 2022 whichever is less. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ the previous age was 70½. A Roth IRA is another way that workers can stash some cash for.

Annually the IRS sets a maximum IRA contribution limits based on inflation measured by CPI. Roth IRA Contribution Limits. Roth IRA Contribution Limits for 2021 and 2022.

You cant make a Roth IRA contribution if your modified AGI is 208000 or more. Converted a traditional IRA to the Roth IRA. You can mail your IRA contribution and youll meet the deadline if its postmarked by the original due date for filing Form 1040.

You cant make a Roth IRA contribution if your modified AGI is 140000 or more. Like a traditional 401kand unlike a Roth IRAyou do have to take a required minimum distribution RMD from a Roth 401k unless youre still working for that employer. From IRS Publication.

Know the Rules. All SEP-IRA contributions are considered to be made by employers on behalf of their workers. The money then compounds tax-free.

In 2020 a record 90 percent of eligible participants made a contribution to a plan. First place your contribution in a traditional IRAwhich has no income limits. If you withdraw less than the RMD amount you may owe a 50 penalty tax on the difference.

If the return is not. The Roth IRA has contribution limits which are 6000 for 2022. Rather a backdoor Roth IRA is a strategy that helps you save retirement funds in a Roth IRA even though your annual income would otherwise disqualify you from accessing this type of individual.

One of the nicest features of the SEP plan is the large amount you can put away for retirement. Rolled over a Roth 401k or Roth 403b to the Roth IRA. No cash value and void if transferred or where prohibited.

For example a 6000 contribution to a pre-tax retirement plan is an untaxed contribution and therefore its tax- deductible. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you. Since 1998 non-working spouses can also contribute up to the same limit as an individual.

In 2021 the Roth IRA contribution limit remains at 6000 with a 1000 catch-up contribution if you are 50 or over. If you are eligible you can make tax deductible contributions to a traditional IRA and accumulate earnings within the IRA tax-free until you are required to begin making withdrawalsusually in the year you turn 72. If youre in the 24 tax bracket you have to earn about 7895 pre-tax to make that contribution.

Your Roth IRA contribution limit however depends on your modified adjusted gross income AGI and filing status. Converting your Traditional IRA to a Roth IRA. Use a Roth conversion to turn your IRA savings into tax-free RMD-free withdrawals in retirement.

SEP-IRA Contribution Limits. Heres how a Roth IRA works who qualifies and FAQs. The lower of 6000 or your taxable compensation.

If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. A Roth IRA is one of the best accounts for growing tax-free retirement savings and it takes just 15 minutes to open one. When Not to Open a Roth IRA.

Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts. Publication 590-B 2020. The contribution begins phasing out at 129000 for single filers and.

Roth IRA calculator. If youre under age 59½ and you have one Roth IRA that holds proceeds from multiple conversions youre required to keep track of the 5-year holding period for each conversion separately. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

Sometimes FMV and RMD calculations need to be adjusted after December 31. Please speak with your tax advisor regarding the impact of this change on future RMDs. A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning.

You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all Traditional andor Roth IRAs totals no more than 6000 7000 for those age 50 and over for tax year 2021 and no more than 6000 7000 for those age 50 and over for tax year 2022. For workers ages 50 and older an additional 1000 can be contributed for a total of 7000 per year. On the other hand to make a 6000 Roth IRA contribution youd have to have 6000 after you paid tax.

First contributed directly to the Roth IRA. Converting to a Roth IRA may ultimately help you save money on income taxes. The Roth IRA is attractive for lower-income earners because you get to contribute lower-tax or no-tax money.

Roth IRAs have the same annual contribution limits as traditional IRAs for 2021 and 2022. The historical Roth IRA contribution limits have steady increased since the Roth IRA was first introduced in 1997. Act in March 2020 allowed for the withdrawal of up to 100000 from Roth or traditional IRAs without having to pay the 10.

A Roth IRA is a retirement account in which after-tax money grows tax-free and withdrawals are tax-free. Learn how they are determined and how you can fund these accounts.

What Is The Best Roth Ira Calculator District Capital Management

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Historical Roth Ira Contribution Limits Since The Beginning

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

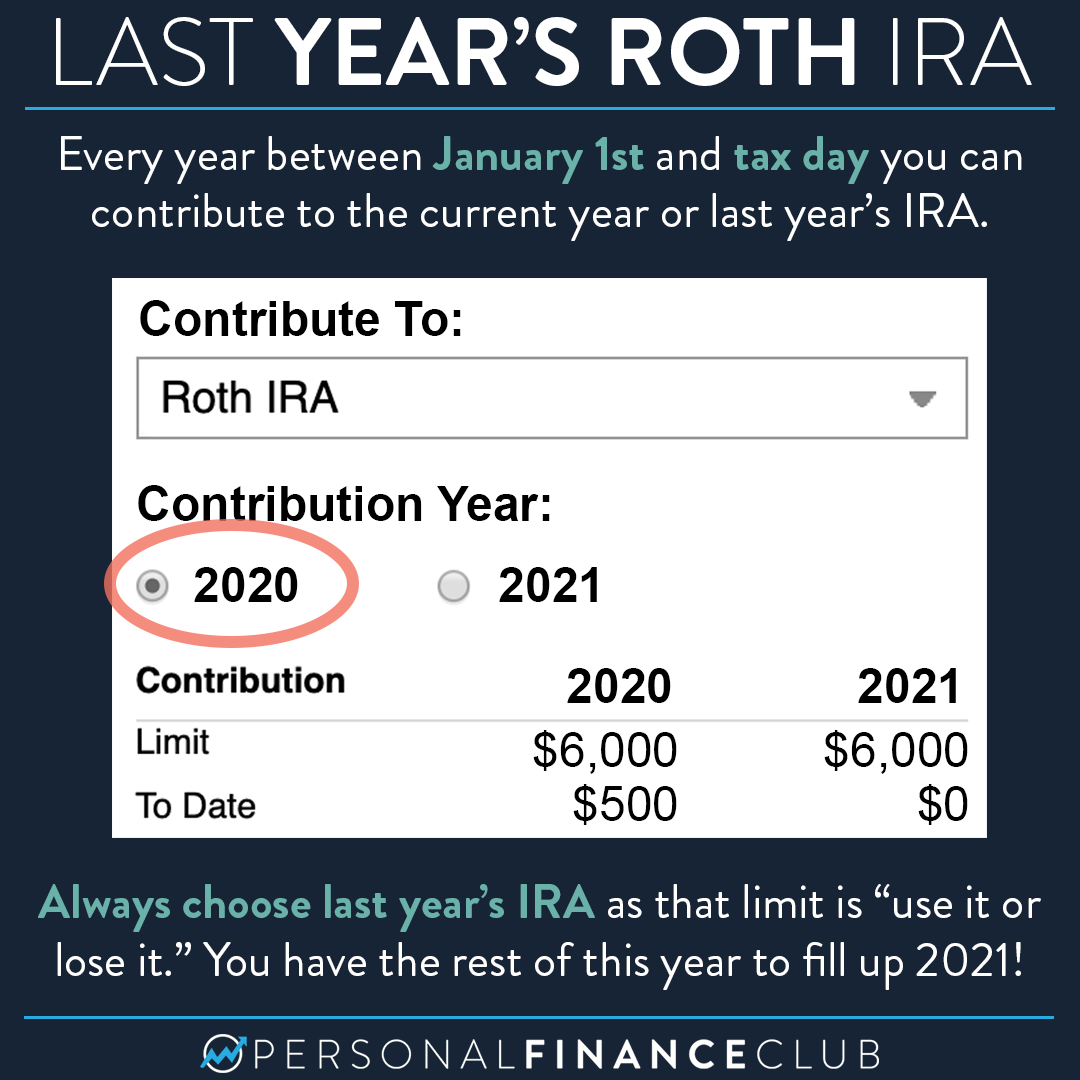

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Historical Roth Ira Contribution Limits Since The Beginning

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution